Travel Insurance: Complete Guide to Coverage, Benefits, and Buying

Travel Insurance: A Complete Guide to Safe, Smart, and Confident Travel

Travel opens the door to new experiences, cultures, and opportunities. Whether traveling for leisure, business, study, or family reasons, every trip comes with uncertainty. Flight delays, lost baggage, sudden illness, or unexpected emergencies can turn a well-planned journey into a stressful situation.

This is why travel insurance has become an essential part of modern travel planning. This guide explains what travel insurance is, how it works, its benefits, the technology behind today’s policies, real-world product examples, practical use cases, and how to buy the right coverage confidently.

Understanding Travel Insurance

What Travel Insurance Is and How It Works

Travel insurance is a policy designed to protect travelers against unexpected events before and during a trip. It provides financial protection and assistance when things do not go as planned, such as medical emergencies, trip cancellations, travel delays, or lost personal belongings.

Coverage typically begins when the policy is purchased and remains active throughout the travel period. Depending on the policy, it may also cover events that occur before departure, such as trip cancellation due to illness or unforeseen circumstances.

Why Travel Insurance Is Essential for Modern Travelers

Travel today involves complex logistics, international regulations, and varying healthcare systems. Even short trips can be disrupted by factors beyond a traveler’s control.

Travel insurance acts as a safety net. It reduces financial risk, provides access to emergency support, and allows travelers to focus on their journey rather than worrying about worst-case scenarios.

Core Benefits of Travel Insurance

Medical Coverage and Emergency Assistance

One of the most important benefits of travel insurance is medical coverage. Healthcare costs abroad can be extremely high, especially in countries with private healthcare systems.

Travel insurance helps cover emergency medical treatment, hospital stays, diagnostic tests, medication, and sometimes follow-up care. Many policies also include 24/7 emergency assistance, ensuring travelers can access help quickly when needed.

Protection Against Trip Disruptions

Travel plans can change unexpectedly due to illness, weather events, airline disruptions, or personal emergencies. Travel insurance can reimburse non-refundable expenses such as flights, accommodation, and tour bookings.

This protection helps travelers recover financially from disruptions that would otherwise result in significant losses.

Technology Behind Modern Travel Insurance

Digital Policy Management and Claims Processing

Modern travel insurance providers use digital platforms that allow customers to purchase policies, access documents, and submit claims online. Mobile apps and online dashboards make it easy to manage coverage while traveling.

Digital claims processing speeds up reimbursements and reduces paperwork, improving the overall customer experience.

Global Assistance Networks and Real-Time Support

Travel insurance providers are supported by global assistance networks operating 24/7. These networks help travelers locate hospitals, arrange emergency transport, communicate with local providers, and coordinate care.

This technology ensures travelers receive timely support regardless of their location, language barriers, or local healthcare systems.

Types of Travel Insurance Coverage

Single-Trip and Annual Travel Insurance

Single-trip travel insurance covers one specific journey, making it suitable for occasional travelers. Annual travel insurance covers multiple trips within a year, offering better value and convenience for frequent travelers.

Choosing the right type depends on travel frequency, trip duration, and personal travel habits.

Specialized Coverage Options

Travel insurance can be customized with additional coverage options such as winter sports, cruises, adventure activities, business travel, or extended medical coverage.

These options allow travelers to tailor their policy to match their specific travel needs and activities.

Real-World Travel Insurance Products

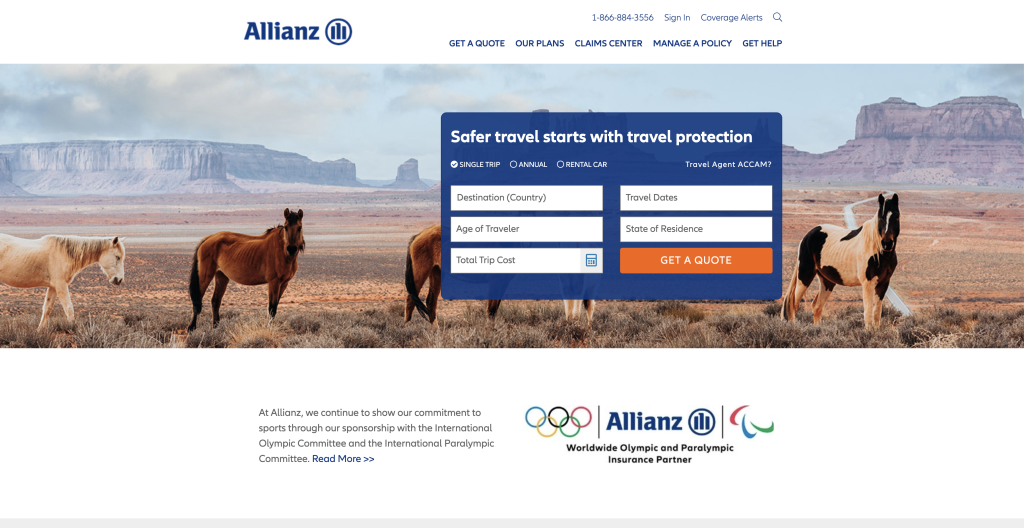

Allianz Travel Insurance

Allianz is one of the most recognized travel insurance providers globally. Its policies offer comprehensive medical coverage, trip cancellation protection, baggage coverage, and emergency assistance.

Allianz is known for its strong global medical network and reliable claims handling, making it a trusted choice for many travelers.

Use case: Ideal for travelers seeking dependable, full-coverage insurance from a well-established global insurer.

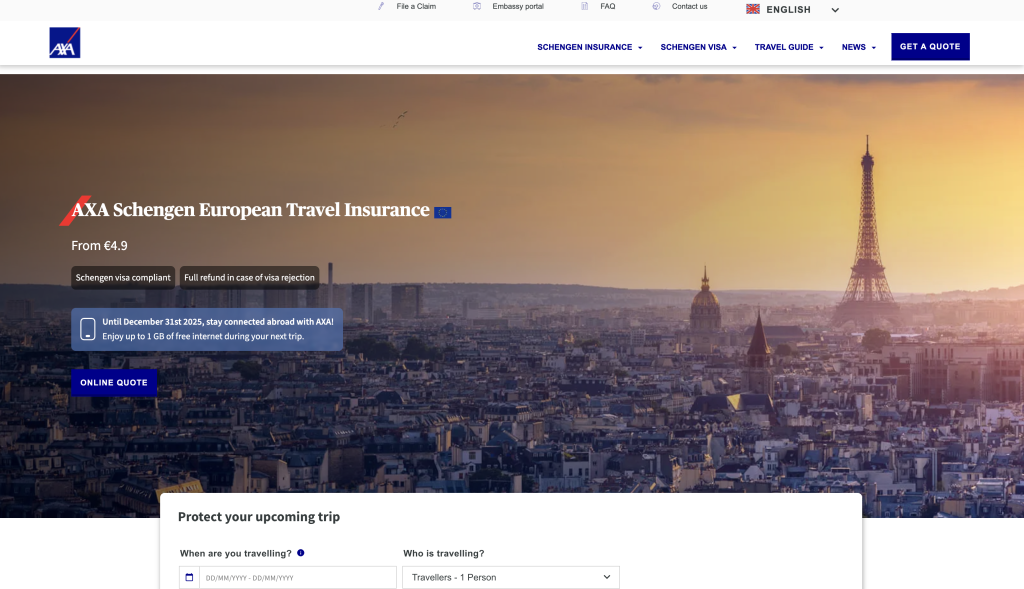

AXA Travel Insurance

AXA offers travel insurance policies widely accepted for international travel, including Schengen visa requirements. Its coverage includes medical expenses, trip interruption, and emergency assistance.

AXA’s strength lies in its extensive healthcare network and clear policy structure.

Use case: Suitable for travelers visiting Europe or destinations with high healthcare costs.

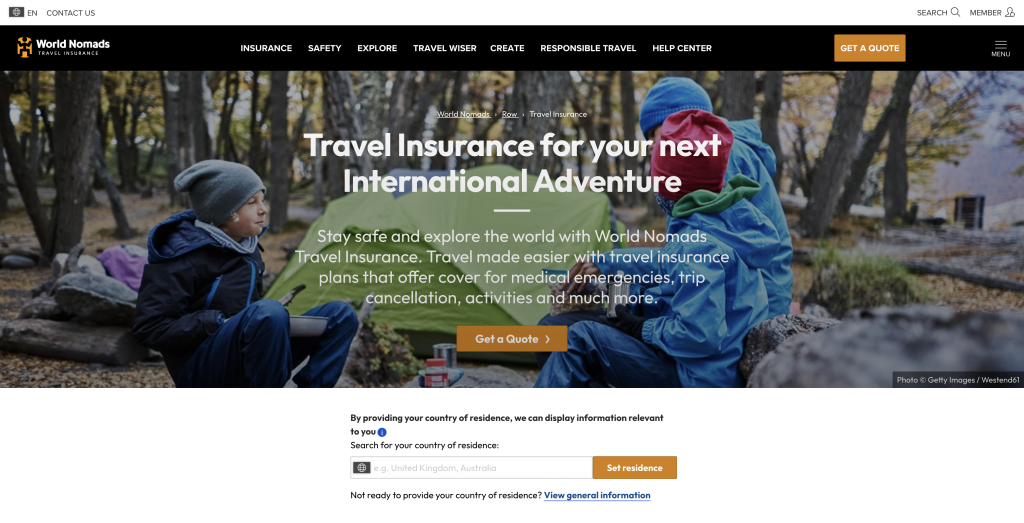

World Nomads Travel Insurance

World Nomads is popular among independent and adventure travelers. It offers flexible coverage options, including emergency medical treatment, evacuation, and trip disruption.

The policy is easy to purchase online and accessible worldwide, making it convenient for international travelers.

Use case: Best for travelers seeking flexible coverage for diverse travel experiences.

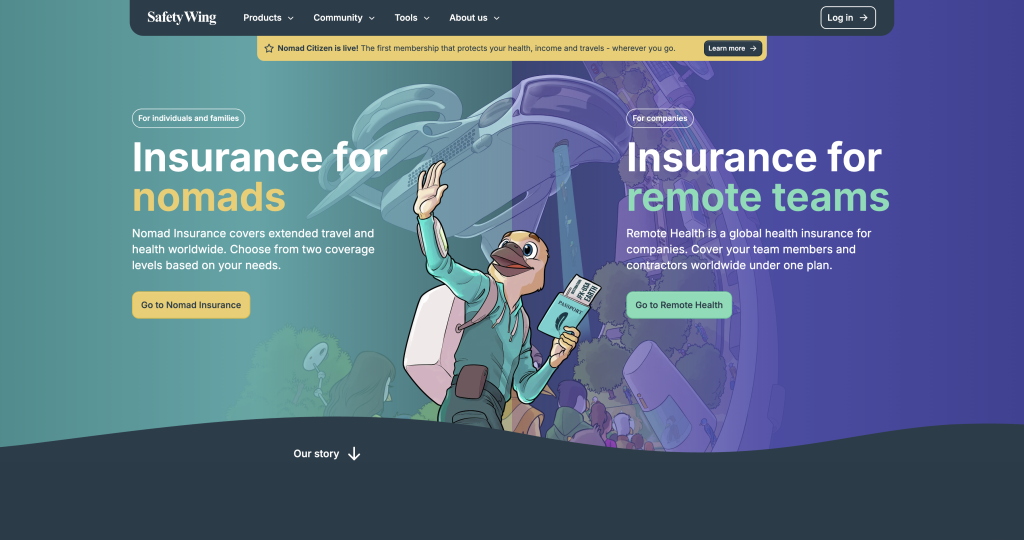

SafetyWing Travel Medical Insurance

SafetyWing is designed for long-term travelers, digital nomads, and remote workers. It offers subscription-based travel medical insurance with global coverage.

The platform is fully digital and easy to manage, providing ongoing coverage without repeated purchases.

Use case: Ideal for travelers who spend extended periods abroad and need continuous medical protection.

IMG Global Travel Insurance

IMG specializes in international medical and travel insurance. Its plans offer flexible coverage limits and extended policy durations.

IMG is often chosen by expatriates, students, and frequent travelers who need comprehensive medical coverage worldwide.

Use case: Suitable for travelers requiring robust medical coverage for international or long-term travel.

Why Travel Insurance Is Important for Every Traveler

Solving Real Travel Risks

Unexpected events can occur on any trip, regardless of destination or duration. Without travel insurance, travelers may face high medical bills, lost travel costs, or limited access to assistance.

Travel insurance solves these problems by providing financial protection and professional support during emergencies.

Peace of Mind Before and During Travel

Knowing that travel insurance is in place allows travelers to plan confidently. It removes uncertainty and reduces stress, enabling travelers to enjoy their trip fully.

This peace of mind is valuable for solo travelers, families, and business travelers alike.

How to Buy Travel Insurance

Steps to Choose the Right Policy

Start by assessing travel needs, including destination, duration, activities, and health considerations. This helps determine the level of coverage required.

Compare policies based on medical limits, trip cancellation coverage, emergency assistance, and insurer reputation. Price should be considered alongside coverage quality.

Where to Buy Travel Insurance Safely

Travel insurance should be purchased from official insurer websites or authorized platforms to ensure policy authenticity and access to customer support.

Example purchase buttons:

<a href=”https://www.allianztravelinsurance.com” target=”_blank”><button>Buy Allianz Travel Insurance</button></a>

<a href=”https://www.axa-schengen.com” target=”_blank”><button>Buy AXA Travel Insurance</button></a>

<a href=”https://www.worldnomads.com” target=”_blank”><button>Buy World Nomads Travel Insurance</button></a>

Who Should Buy Travel Insurance

Leisure and Family Travelers

Holidaymakers and families benefit from protection against medical emergencies, cancellations, and lost belongings, ensuring smoother travel experiences.

Business and Frequent Travelers

Business travelers and frequent flyers benefit from continuous coverage and efficient claims handling, reducing disruptions to professional commitments.

Frequently Asked Questions

Is travel insurance mandatory?

Travel insurance is not always mandatory, but some countries and visa programs require proof of coverage. Even when not required, it is strongly recommended.

Does travel insurance cover all emergencies?

Coverage depends on the policy. Most plans cover medical emergencies, trip cancellations, and travel disruptions, but exclusions apply. Always review policy details.

When should I buy travel insurance?

Travel insurance should be purchased as soon as travel plans are confirmed to maximize coverage for pre-departure events.