Travel Insurance Compare: How to Choose the Best Coverage

Travel Insurance Compare: A Complete Guide to Finding the Best Coverage for Your Trip

Choosing travel insurance is no longer just about buying the cheapest policy. With rising medical costs, frequent travel disruptions, and varying coverage terms, knowing how to compare travel insurance properly has become essential for modern travelers.

Searching for travel insurance compare usually means one thing: you want the best value, the right coverage, and confidence that your policy will actually protect you when something goes wrong. This guide explains how travel insurance comparison works, what to compare, the benefits of choosing the right policy, real-world insurance providers, and how to buy safely.

Understanding Travel Insurance Comparison

What “Travel Insurance Compare” Really Means

Comparing travel insurance is the process of evaluating multiple insurance policies to determine which one offers the most suitable coverage for your needs. This includes comparing medical benefits, trip cancellation protection, baggage coverage, exclusions, limits, and customer support.

Travel insurance comparison is not just about price. A cheaper policy with low medical limits or strict exclusions can cost far more in the long run if an emergency occurs.

Why Comparing Travel Insurance Is Essential

Travelers face different risks depending on destination, duration, activities, and personal circumstances. A one-size-fits-all policy rarely provides optimal protection.

By comparing travel insurance, travelers can avoid underinsurance, unnecessary add-ons, and policies that fail to cover real-world travel risks. Comparison ensures smarter decisions and better protection.

What to Compare When Choosing Travel Insurance

Medical Coverage and Emergency Assistance

Medical coverage is the most critical component of any travel insurance policy. When comparing policies, look at emergency medical limits, hospital coverage, medication costs, and emergency evacuation benefits.

Some policies offer high medical limits but restrict coverage in certain countries. Others provide global coverage with strong 24/7 assistance networks. Comparing these details ensures you are protected where it matters most.

Trip Cancellation, Delay, and Interruption Benefits

Travel plans can change due to illness, family emergencies, airline disruptions, or natural events. Trip cancellation and interruption coverage reimburses non-refundable expenses.

When comparing travel insurance, review covered reasons, reimbursement limits, and whether delays or missed connections are included. These details can make a significant difference during disruptions.

Benefits of Comparing Travel Insurance Before Buying

Better Value for Money

Comparing travel insurance helps travelers avoid overpaying for unnecessary coverage while ensuring essential protection is included.

A well-compared policy balances cost and coverage, delivering better value than simply choosing the cheapest option.

Coverage That Matches Real Travel Needs

Every traveler has different priorities. Some need high medical coverage, while others focus on trip cancellation or adventure activities.

Comparing travel insurance allows travelers to match coverage to their actual travel behavior, reducing gaps and unnecessary risks.

Technology Behind Modern Travel Insurance Comparison

Online Comparison Platforms and Tools

Many travelers use online tools to compare travel insurance quickly. These platforms allow users to filter policies based on destination, duration, age, and coverage type.

Technology makes it easier to review policy highlights, exclusions, and benefits side by side, saving time and reducing confusion.

Digital Policy Access and Claims Support

Modern insurers provide digital policy documents, mobile apps, and online claims submission. When comparing travel insurance, consider how easy it is to manage the policy and file claims digitally.

Insurers with strong digital systems often provide faster claims processing and better customer experience.

Real-World Travel Insurance Providers to Compare

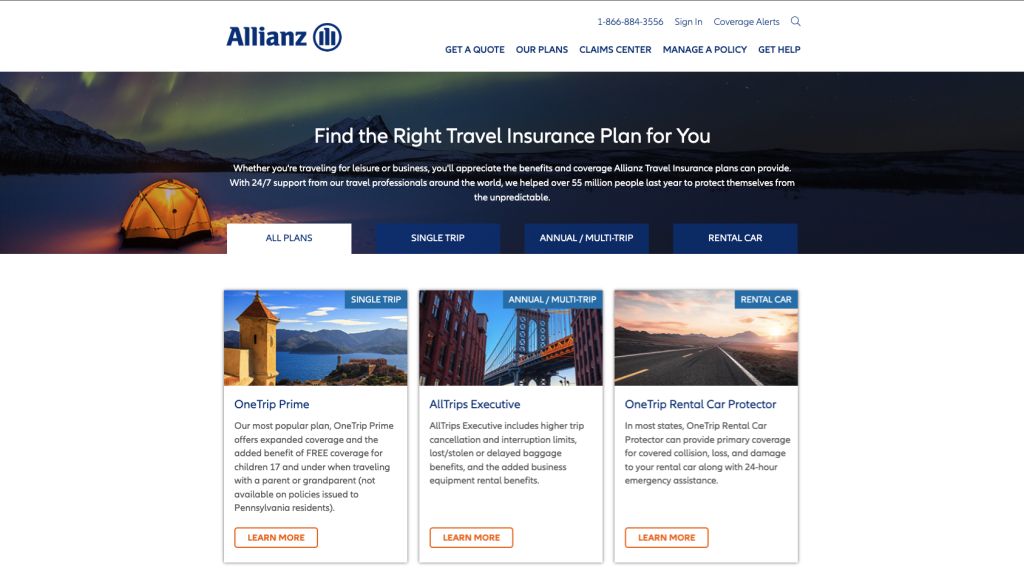

Allianz Travel Insurance

Allianz is one of the most established travel insurance providers worldwide. Its policies offer comprehensive medical coverage, trip cancellation protection, and global emergency assistance.

Allianz is known for its strong international hospital network and structured claims handling, making it a benchmark provider when comparing travel insurance.

Use case: Ideal for travelers seeking reliable, all-around protection from a globally recognized insurer.

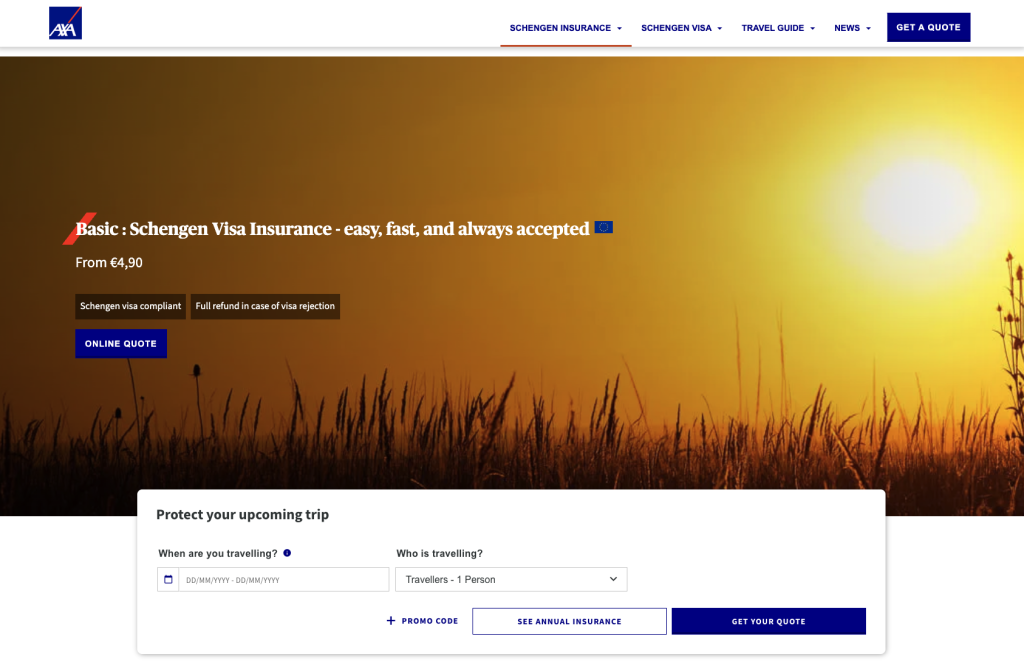

AXA Travel Insurance

AXA is widely used for international and European travel. Its policies are often accepted for visa requirements and offer solid medical and trip protection.

AXA provides clear policy terms and extensive medical networks, making it a strong option when comparing travel insurance for high-cost destinations.

Use case: Suitable for travelers heading to Europe or destinations requiring proof of insurance.

World Nomads Travel Insurance

World Nomads appeals to independent and adventure travelers. Its coverage includes medical treatment, evacuation, and trip interruption.

The policy is flexible and easy to purchase online, making it popular among international travelers who value accessibility.

Use case: Best for travelers comparing flexible coverage for diverse travel experiences.

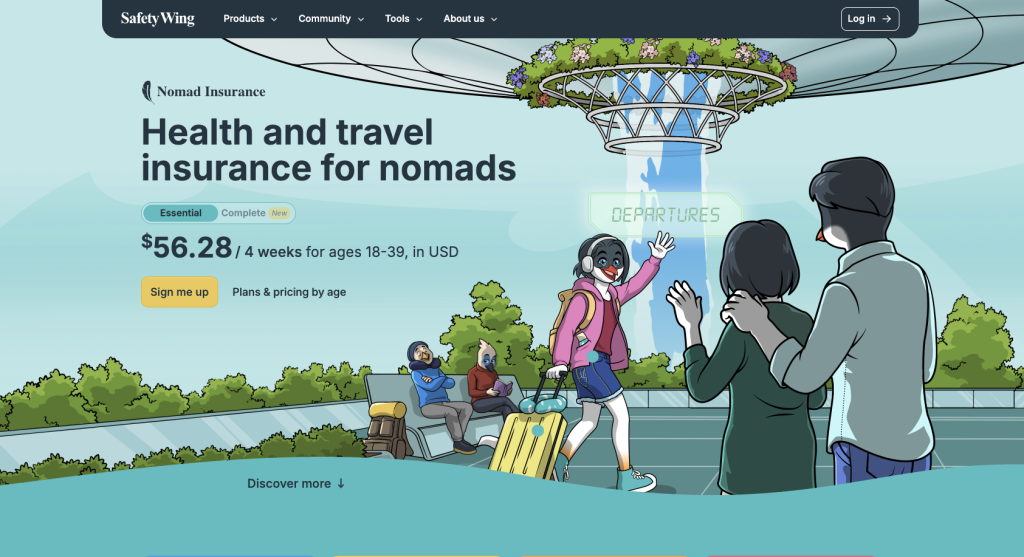

SafetyWing Travel Insurance

SafetyWing offers subscription-based travel medical insurance designed for long-term travelers and digital nomads.

Its continuous coverage model stands out when comparing travel insurance for extended or frequent international travel.

Use case: Ideal for travelers spending long periods abroad who need ongoing medical coverage.

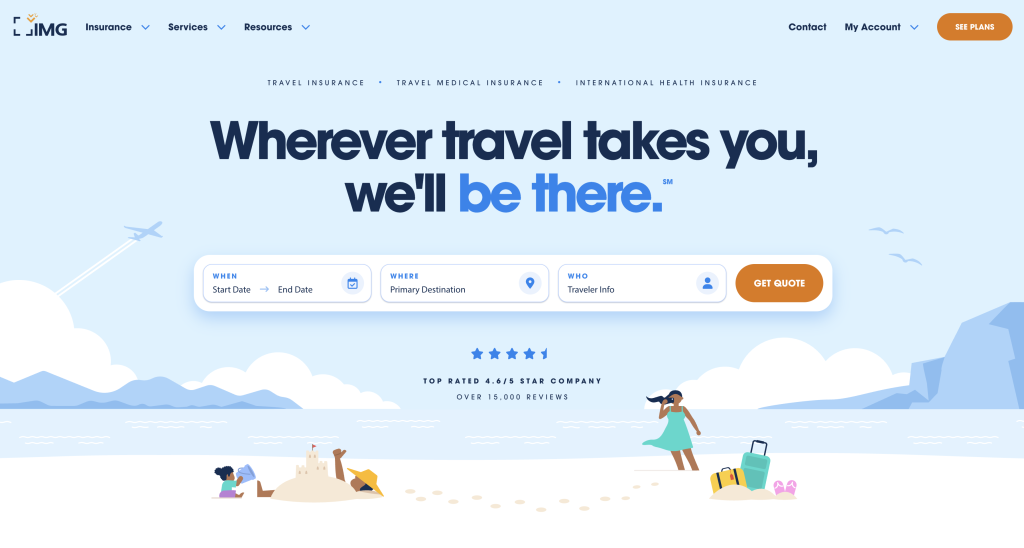

IMG Global Travel Insurance

IMG specializes in international medical and travel insurance with flexible coverage limits and extended policy durations.

IMG is often chosen by expatriates, students, and frequent travelers who need robust medical coverage.

Use case: Suitable for travelers comparing long-term or high-limit medical insurance options.

How Travel Insurance Comparison Solves Common Problems

Avoiding Coverage Gaps

Many travelers only realize what their insurance does not cover when they need it most. Comparing travel insurance highlights exclusions and limitations before purchase.

This prevents surprises such as denied medical claims or uncovered cancellations.

Reducing Financial Risk During Travel

Medical emergencies, trip disruptions, and lost belongings can be financially devastating without proper insurance.

Comparing travel insurance ensures travelers choose policies that protect them against the most expensive and common risks.

How to Compare and Buy Travel Insurance Safely

Step-by-Step Comparison Process

Start by identifying your travel needs: destination, trip length, activities, and personal health considerations. This narrows down suitable policy types.

Next, compare medical limits, trip cancellation coverage, emergency assistance services, and exclusions. Always read policy wording summaries carefully.

Where to Buy Travel Insurance

Travel insurance should be purchased directly from official insurer websites or trusted comparison platforms to ensure policy authenticity and customer support.

Who Should Always Compare Travel Insurance

Leisure and Family Travelers

Families and holiday travelers benefit from comparing policies to ensure adequate medical and cancellation coverage for all travelers.

Comparison helps balance affordability and protection for group travel.

Frequent and International Travelers

Frequent travelers often need annual or multi-trip policies. Comparing travel insurance ensures they get consistent coverage without paying repeatedly.

It also helps frequent travelers choose insurers with reliable claims handling.

Frequently Asked Questions

Is comparing travel insurance really necessary?

Yes. Policies vary widely in coverage, exclusions, and limits. Comparing ensures you get protection that matches your needs.

Is the cheapest travel insurance the best option?

Not always. Cheaper policies may have lower medical limits or stricter exclusions. Value matters more than price alone.

When should I compare and buy travel insurance?

Travel insurance should be compared and purchased as soon as travel plans are confirmed to maximize coverage benefits.