Post Office Travel Insurance: Complete Guide to Cover & Benefits

Post Office Travel Insurance: A Complete Guide to Coverage, Benefits, and Smart Buying

When planning a trip, many travelers look for insurance that feels familiar, reliable, and easy to understand. For millions of travelers in the UK and beyond, Post Office Travel Insurance is often one of the first options considered. Its long-standing reputation, physical branch presence, and broad range of policies make it a popular choice for holidaymakers, families, and frequent travelers.

This guide explains everything you need to know about post office travel insurance, including how it works, what it covers, its benefits, the technology behind modern policies, comparable real-world alternatives, and how to buy the right cover with confidence.

Understanding Post Office Travel Insurance

What Post Office Travel Insurance Is

Post Office Travel Insurance is a travel insurance product offered under the trusted Post Office brand, providing protection for holidays and trips both in the UK and abroad. Policies typically include medical cover, trip cancellation, baggage protection, and travel disruption benefits.

The appeal of Post Office Travel Insurance lies in its accessibility. Travelers can purchase policies online or in-branch, making it suitable for those who prefer a familiar and straightforward buying experience.

Who Post Office Travel Insurance Is Designed For

Post Office Travel Insurance is designed for a wide range of travelers, including single-trip holidaymakers, families, older travelers, and frequent travelers who need annual cover. Policies are structured to be easy to understand, with clearly defined levels of protection.

For travelers who value brand trust and customer support, Post Office Travel Insurance often feels like a safe and dependable choice.

Core Benefits of Post Office Travel Insurance

Medical Coverage and Emergency Support

Medical emergencies abroad can be costly and stressful. Post Office Travel Insurance typically includes cover for emergency medical treatment, hospital stays, and repatriation when required.

Many policies are supported by 24/7 emergency assistance services, ensuring travelers can access help quickly if they fall ill or are injured while away.

Trip Cancellation and Disruption Protection

Travel plans can change unexpectedly due to illness, family emergencies, or unforeseen events. Post Office Travel Insurance can reimburse non-refundable travel costs if a trip needs to be cancelled or cut short for covered reasons.

This benefit is especially important for holidays involving prepaid flights, accommodation, and excursions.

Technology Behind Modern Post Office Travel Insurance

Digital Policy Management and Online Access

Modern Post Office Travel Insurance policies are supported by digital systems that allow customers to access policy documents online, manage details, and find emergency contact information easily.

This digital accessibility ensures travelers can retrieve essential information while abroad without carrying physical paperwork.

Claims Processing and Assistance Networks

Claims are typically handled through structured digital or phone-based processes, supported by global assistance providers. These networks help coordinate medical care, travel arrangements, and reimbursements.

The use of technology improves response times and helps travelers navigate emergencies more efficiently.

Types of Post Office Travel Insurance Policies

Single-Trip Travel Insurance

Single-trip Post Office Travel Insurance covers one specific journey, from departure to return. It is suitable for travelers taking one or two holidays per year.

This policy allows travelers to tailor coverage to the destination and duration of a specific trip.

Annual Multi-Trip Travel Insurance

Annual Post Office Travel Insurance covers multiple trips within a 12-month period, with each trip subject to a maximum length. This option offers better value for frequent travelers.

Annual cover reduces the need to buy insurance repeatedly and ensures continuous protection throughout the year.

Real-World Travel Insurance Products to Compare

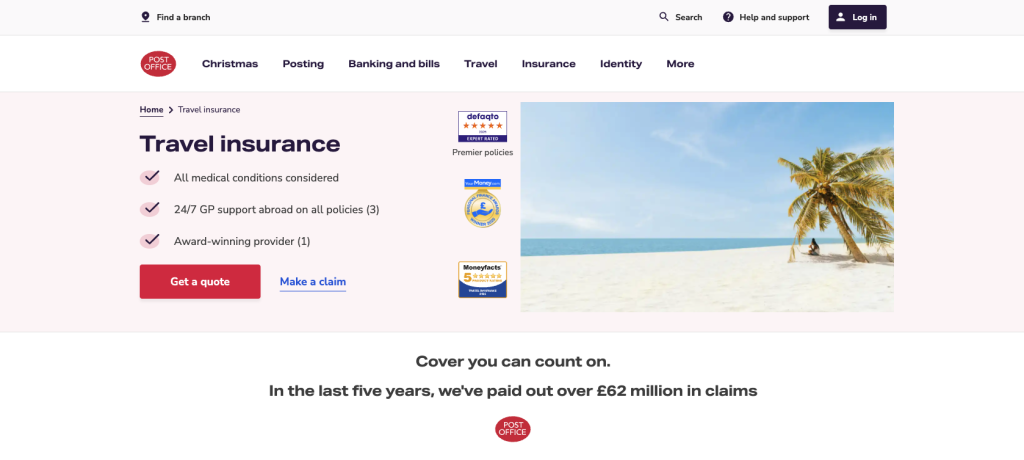

Post Office Travel Insurance

Post Office Travel Insurance offers a range of policies, including single-trip and annual cover. Medical, cancellation, baggage, and disruption benefits are included at different levels depending on the plan selected.

The brand’s physical branch network and online presence make it accessible to a wide range of travelers.

Use case: Ideal for travelers who prefer a familiar, trusted brand with straightforward coverage options.

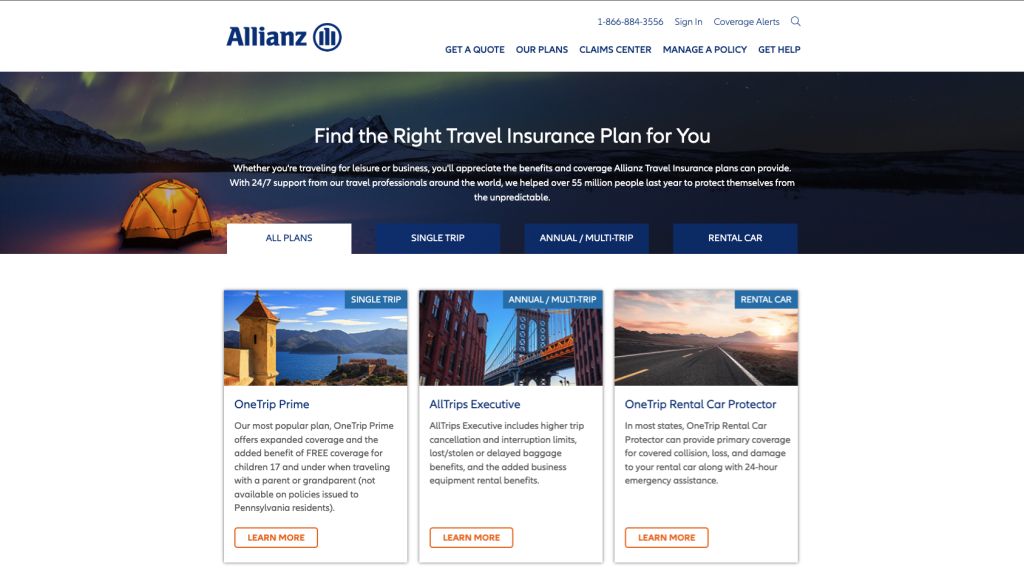

Allianz Travel Insurance

Allianz is a global insurance provider known for comprehensive travel coverage and strong medical assistance networks. Policies include high medical limits, trip cancellation protection, and emergency services.

Allianz often appeals to travelers seeking robust international support and a globally recognized insurer.

Use case: Suitable for travelers comparing Post Office Travel Insurance with a global premium provider.

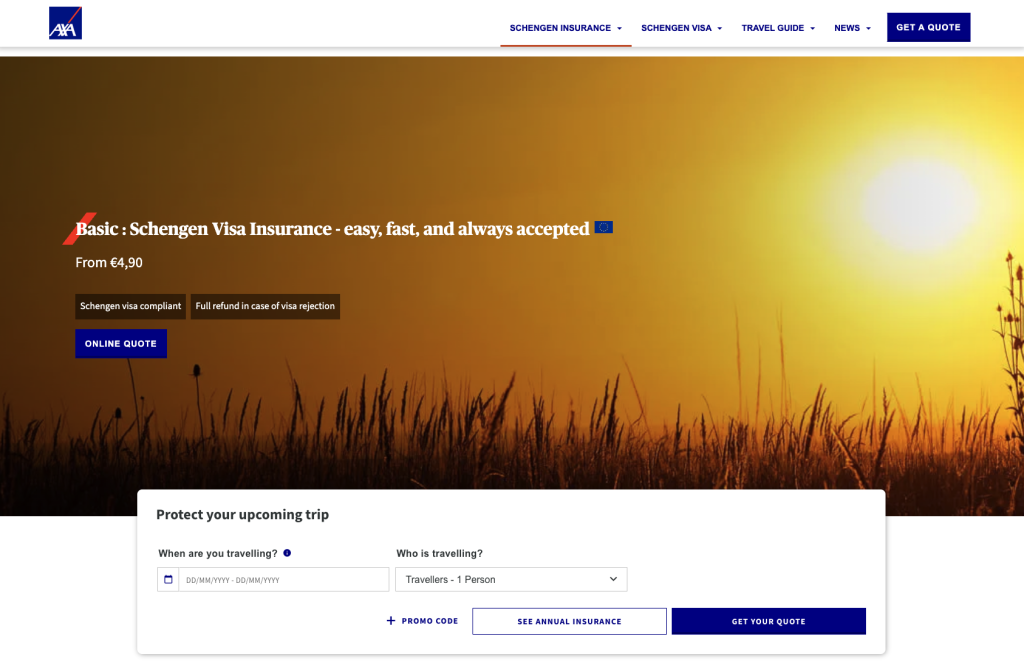

AXA Travel Insurance

AXA offers travel insurance widely accepted for European and international travel. Coverage includes medical expenses, trip disruption, and emergency assistance.

AXA’s medical network and clear policy structure make it a strong alternative for travelers comparing coverage options.

Use case: Ideal for travelers heading to Europe or destinations requiring proof of insurance.

World Nomads Travel Insurance

World Nomads provides flexible travel insurance popular among independent and experience-driven travelers. Coverage includes medical treatment, evacuation, and trip interruption.

The policy is easy to purchase online and accessible worldwide.

Use case: Best for travelers seeking flexibility beyond traditional holiday insurance.

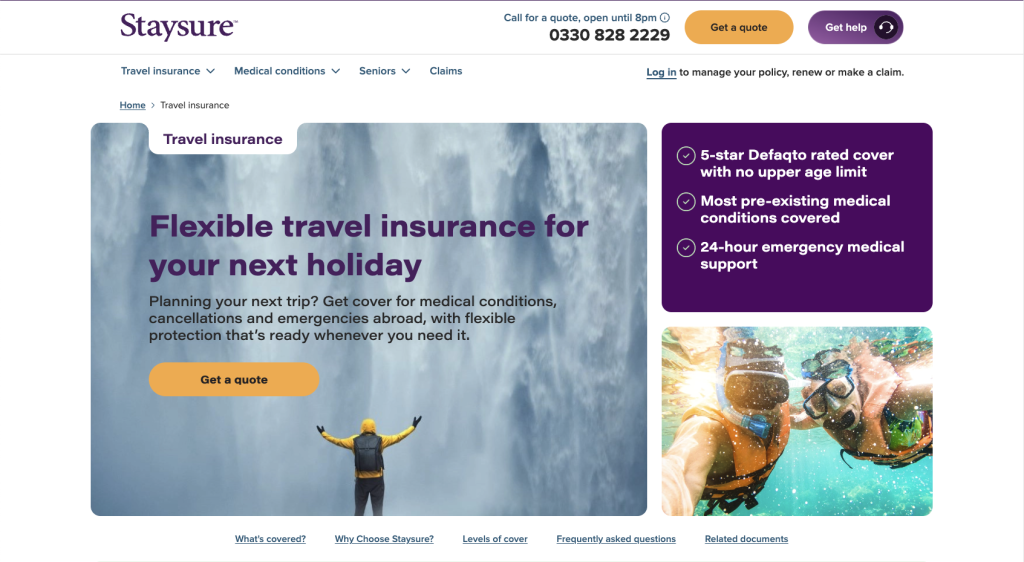

Staysure Travel Insurance

Staysure specializes in travel insurance for older travelers and those with medical conditions. Policies can include declared conditions following medical screening.

Staysure focuses on clarity and tailored coverage, making it a popular comparison option alongside Post Office Travel Insurance.

Use case: Ideal for mature travelers or retirees seeking specialized travel insurance.

Why Travelers Choose Post Office Travel Insurance

Trust and Brand Familiarity

Many travelers choose Post Office Travel Insurance because they trust the brand. The Post Office has a long history of serving the public, which provides reassurance for insurance purchases.

This familiarity can be especially appealing to travelers who prefer established providers over purely digital brands.

Accessibility and Support Options

Post Office Travel Insurance can be purchased online or in branch, offering flexibility for different preferences. Some travelers value face-to-face support when discussing insurance needs.

This accessibility helps simplify the buying process and builds confidence in coverage decisions.

How Post Office Travel Insurance Solves Common Travel Problems

Reducing Financial Risk During Holidays

Unexpected medical emergencies, cancellations, or lost baggage can result in significant costs. Post Office Travel Insurance helps reduce these financial risks by covering eligible expenses.

This protection allows travelers to manage disruptions without major financial stress.

Providing Peace of Mind Before and During Travel

Knowing insurance is in place allows travelers to focus on enjoying their trip rather than worrying about potential problems.

For families, older travelers, and first-time international travelers, this peace of mind is invaluable.

How to Buy Post Office Travel Insurance

Steps to Choose the Right Policy

Start by identifying your travel needs, including destination, duration, number of trips per year, and any special requirements such as medical considerations.

Compare coverage levels carefully, focusing on medical limits, cancellation benefits, baggage protection, and exclusions.

Where to Buy and How to Purchase Safely

Post Office Travel Insurance can be purchased directly through the official Post Office website or at a local branch. Buying directly ensures policy authenticity and access to customer support.

Who Should Consider Post Office Travel Insurance

Holiday and Family Travelers

Families and leisure travelers benefit from the straightforward structure and familiar branding of Post Office Travel Insurance.

Coverage for medical emergencies and cancellations makes it suitable for typical holiday travel.

Older and Traditional Buyers

Travelers who prefer in-branch services or value long-established brands often find Post Office Travel Insurance appealing.

This group may prioritize clarity, support, and brand reputation over advanced digital features.

Frequently Asked Questions

Is Post Office Travel Insurance reliable?

Post Office Travel Insurance is backed by established insurance partners and supported by global assistance networks, making it a reliable option for many travelers.

Can I get annual cover with Post Office Travel Insurance?

Yes. Post Office Travel Insurance offers both single-trip and annual multi-trip policies, depending on travel needs.

Is Post Office Travel Insurance good for international travel?

Yes. Policies typically cover international destinations, but coverage limits and exclusions should always be checked before purchase.