Money Supermarket Travel Insurance: Compare, Cover & Buy Smart

Money Supermarket Travel Insurance: A Complete Guide to Comparing, Choosing, and Buying the Right Cover

Finding the right travel insurance can feel overwhelming. With dozens of insurers, varying levels of medical cover, exclusions hidden in policy wording, and prices that change constantly, many travelers turn to comparison platforms for clarity. One of the most widely used platforms in the UK is Money Supermarket travel insurance.

If you are searching for money supermarket travel insurance, you are likely ready to compare providers, understand real differences between policies, and make a confident buying decision. This guide explains exactly how Money Supermarket travel insurance works, its benefits, the technology behind comparison platforms, real insurance providers featured, practical use cases, and how to buy the right cover safely.

Understanding Money Supermarket Travel Insurance

What Money Supermarket Travel Insurance Actually Is

Money Supermarket travel insurance is not a single insurance product. Instead, it is a comparison platform that allows users to compare travel insurance policies from multiple insurers in one place. The platform displays pricing, coverage highlights, and policy options based on the traveler’s details.

Money Supermarket partners with a wide range of UK and international insurers, making it a popular starting point for travelers who want to see the market before buying.

Who Uses Money Supermarket for Travel Insurance

Money Supermarket is commonly used by UK-based travelers planning holidays, business trips, family travel, or frequent international journeys. It appeals to people who want transparency, price comparison, and the ability to filter policies based on personal needs.

For many travelers, Money Supermarket provides reassurance that they are not overpaying or missing better options elsewhere.

Key Benefits of Using Money Supermarket Travel Insurance

Access to Multiple Insurers in One Place

One of the biggest advantages of Money Supermarket travel insurance is access to a wide selection of insurers through a single platform. Instead of visiting multiple websites individually, travelers can compare policies side by side.

This saves time and makes it easier to identify meaningful differences in medical cover, cancellation limits, and exclusions.

Price Transparency and Competitive Rates

Money Supermarket displays prices clearly, allowing travelers to see how premiums vary between insurers. This transparency helps users understand what they are paying for and whether higher-priced policies offer better value.

While price is important, the platform encourages comparison of coverage details, helping travelers avoid choosing policies based on cost alone.

Technology Behind Money Supermarket Travel Insurance Comparison

Smart Filters and Instant Quotes

Money Supermarket uses advanced filtering technology to generate instant travel insurance quotes. Users input details such as destination, travel dates, age, and coverage type, and the system automatically matches them with suitable policies.

Filters allow users to narrow results based on medical cover limits, cancellation protection, excess levels, and optional add-ons.

Digital Policy Access and Seamless Buying

Once a policy is selected, users are usually redirected to the insurer’s website to complete the purchase. Policy documents are provided digitally, and many insurers offer online account management and claims submission.

This integration ensures a smooth transition from comparison to purchase, without unnecessary complexity.

Types of Travel Insurance Available on Money Supermarket

Single-Trip Travel Insurance

Single-trip travel insurance covers one specific journey, from departure to return. This option is suitable for travelers taking one holiday or trip per year.

Money Supermarket allows easy comparison of single-trip policies based on destination, duration, and coverage needs.

Annual Multi-Trip Travel Insurance

Annual travel insurance covers multiple trips within a 12-month period, with each trip subject to a maximum duration. This option is often more cost-effective for frequent travelers.

Money Supermarket helps users compare annual policies to find the best balance between price and coverage.

Real-World Travel Insurance Providers on Money Supermarket

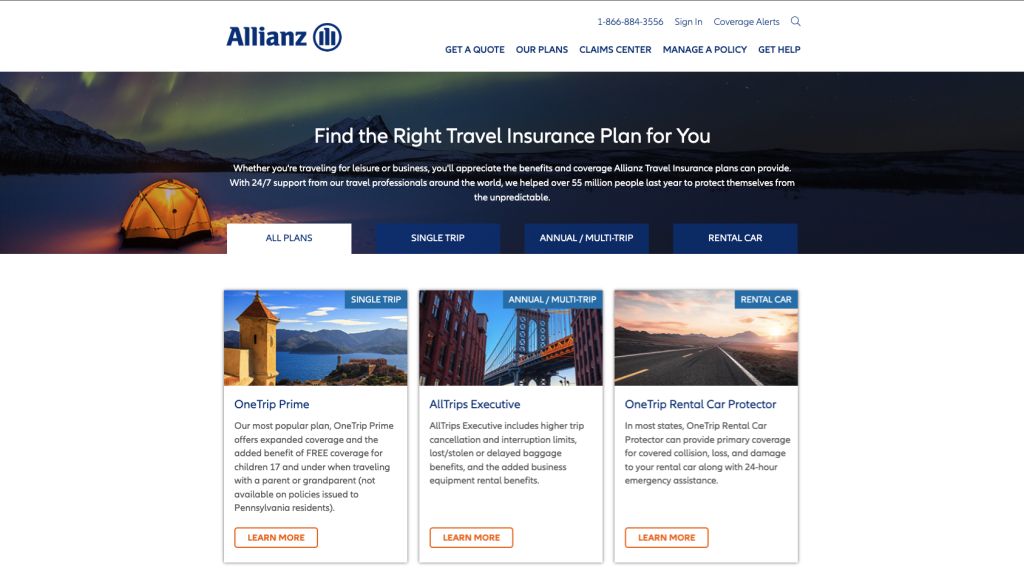

Allianz Travel Insurance

Allianz is frequently listed on Money Supermarket due to its comprehensive coverage and global reputation. Policies include strong medical limits, cancellation protection, and 24/7 emergency assistance.

Allianz is known for reliable claims handling and access to an extensive international medical network.

Use case: Ideal for travelers comparing premium insurers with strong global medical support.

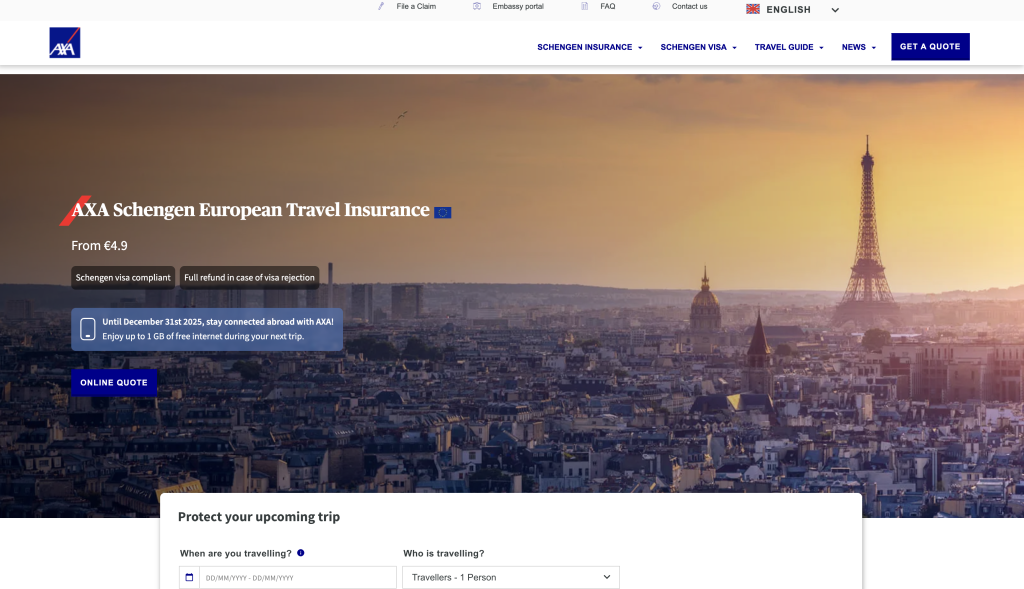

AXA Travel Insurance

AXA is a common option on Money Supermarket, particularly for European and international travel. Its policies often meet visa requirements and offer robust medical and disruption cover.

AXA’s clarity and international presence make it a strong competitor in comparisons.

Use case: Suitable for travelers visiting Europe or destinations with high healthcare costs.

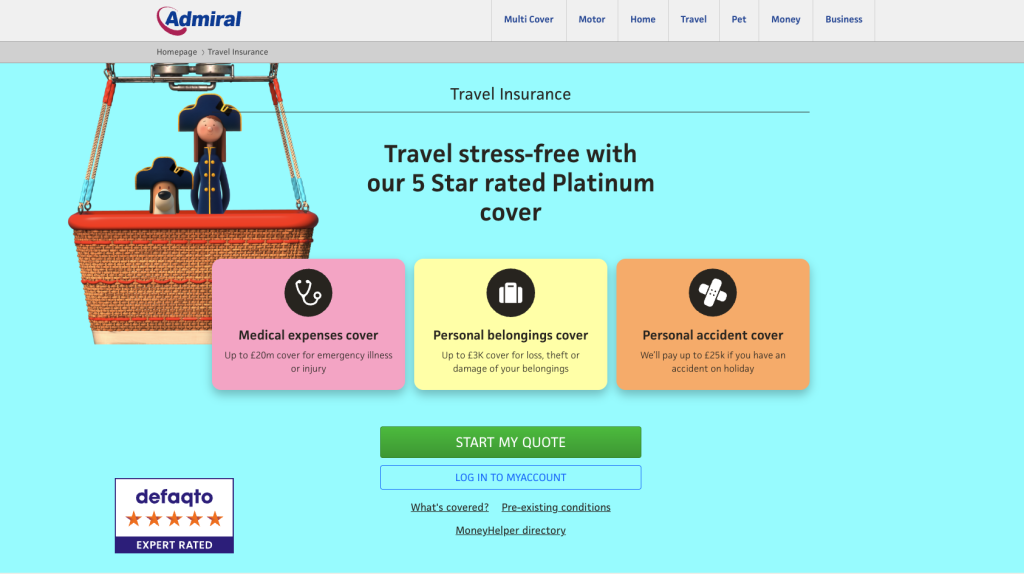

Admiral Travel Insurance

Admiral Travel Insurance is popular among UK customers and frequently appears on Money Supermarket. It offers both single-trip and annual policies with clear coverage structures.

Admiral appeals to travelers who value familiar UK insurance brands.

Use case: Best for travelers comparing trusted domestic insurers.

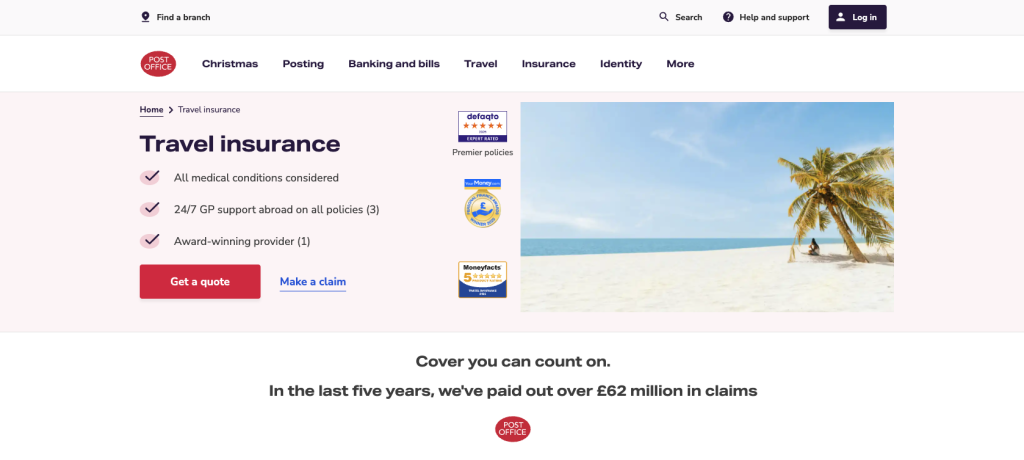

Post Office Travel Insurance

Post Office Travel Insurance is widely recognised and often featured on Money Supermarket. It offers accessible coverage through both online and in-branch options.

Its brand familiarity makes it appealing to traditional buyers.

Use case: Suitable for travelers who prefer well-established UK providers.

Staysure Travel Insurance

Staysure specialises in travel insurance for older travelers and those with medical conditions. It frequently appears in Money Supermarket search results for tailored coverage.

Staysure focuses on transparency and medical screening clarity.

Use case: Ideal for mature travelers or those with pre-existing conditions.

Why Money Supermarket Travel Insurance Solves Common Problems

Avoiding Underinsurance and Hidden Exclusions

Many travelers only discover policy exclusions when they try to make a claim. Money Supermarket allows users to review coverage highlights before buying.

This reduces the risk of choosing insurance that looks cheap but offers limited real-world protection.

Reducing Financial Risk While Traveling

Medical emergencies, trip cancellations, and lost baggage can result in major financial loss. Comparing policies through Money Supermarket helps travelers select cover that protects against the most expensive risks.

This ensures insurance works when it is truly needed.

How to Use Money Supermarket Travel Insurance Effectively

Step One: Define Your Travel Needs Clearly

Before comparing, identify destination, trip length, number of travelers, and any special requirements such as medical conditions or activities.

Clear inputs result in more accurate and relevant comparison results.

Step Two: Compare Coverage, Not Just Price

Focus on medical limits, cancellation protection, excess levels, and exclusions. A slightly higher premium can provide significantly better protection.

Money Supermarket makes it easy to see these differences side by side.

How and Where to Buy After Comparing

Buying Through Money Supermarket

After comparing options, users can select a policy and proceed to purchase via the insurer’s website. This ensures direct access to policy documents and customer support.

Always review full policy wording before final confirmation.

Buying Directly From Insurers

Some travelers use Money Supermarket for research, then buy directly from insurers they trust.

Example purchase buttons:

Who Should Use Money Supermarket Travel Insurance

Families and Holiday Travelers

Families benefit from comparing multiple insurers to balance affordability and strong cancellation and medical cover.

Money Supermarket simplifies finding suitable family-friendly policies.

Frequent and Budget-Conscious Travelers

Frequent travelers can compare annual policies easily, while budget-conscious travelers can identify value-for-money options without sacrificing essential coverage.

Frequently Asked Questions

Is Money Supermarket travel insurance cheaper?

Money Supermarket often shows competitive prices, but the cheapest policy is not always the best. Coverage quality matters more than price alone.

Does Money Supermarket sell insurance directly?

No. Money Supermarket is a comparison platform. Policies are purchased directly from the insurer.

When should I use Money Supermarket to buy travel insurance?

Use Money Supermarket as soon as travel plans are confirmed to compare options and secure the best coverage early.