Compare the Market Travel Insurance: Complete Buying Guide

Compare the Market Travel Insurance: A Complete Guide to Choosing the Right Cover

When planning a trip, most travelers know they need insurance—but far fewer know how to choose the right one. Searching for compare the market travel insurance usually means one thing: you want to see multiple options, understand the differences, and avoid paying for cover that does not actually protect you.

This guide explains how to compare the market for travel insurance properly, what factors really matter, the benefits of comparing instead of buying blindly, real-world insurance providers commonly found on comparison platforms, and how to buy travel insurance confidently and safely.

Understanding What “Compare the Market Travel Insurance” Means

What Travelers Mean When They Search This Term

When people search for “compare the market travel insurance,” they are not just looking for a single policy. They want to review multiple insurers, compare prices and coverage, and choose the best option for their needs.

This search intent is highly transactional. Travelers are usually close to purchasing but want reassurance that they are making a smart decision rather than overpaying or missing essential coverage.

Why Comparison Matters More Than Ever

Travel insurance policies vary widely. Two policies with similar prices can offer completely different medical limits, cancellation protection, or exclusions.

Comparing the market helps travelers avoid underinsurance, unexpected exclusions, and poor claims experiences—issues that only become obvious when something goes wrong.

What to Compare When Using Travel Insurance Comparison Platforms

Medical Coverage and Emergency Limits

Medical cover is the most critical element of any travel insurance policy. When comparing the market, travelers should look closely at emergency medical limits, hospital cover, medication costs, and evacuation benefits.

Some policies appear cheap but cap medical coverage at low amounts. Others provide comprehensive global medical protection backed by strong assistance networks. These differences are crucial.

Cancellation, Curtailment, and Travel Disruption

Holidays often involve prepaid flights, hotels, and experiences. If a trip is cancelled or cut short due to illness or emergencies, cancellation and curtailment cover protects these costs.

Comparing the market allows travelers to see which insurers cover more scenarios, higher reimbursement limits, and additional protections like missed connections or airline delays.

Benefits of Comparing the Market for Travel Insurance

Better Value Without Sacrificing Protection

Comparing the market helps travelers find policies that balance affordability with meaningful coverage. The cheapest policy is rarely the best option.

A well-compared policy offers strong medical cover, fair cancellation benefits, and reasonable exclusions—delivering real value instead of false savings.

Coverage Matched to Real Travel Needs

Different travelers have different priorities. Families, solo travelers, seniors, adventure travelers, and frequent flyers all require different coverage.

Market comparison tools help filter and identify policies that actually match travel style, destination, and personal risk.

Technology Behind Travel Insurance Comparison Platforms

Smart Filtering and Instant Quotes

Comparison platforms use advanced algorithms to filter travel insurance options based on age, destination, trip length, and coverage needs.

This technology allows travelers to instantly compare multiple insurers side by side, saving time and reducing confusion.

Digital Policy Access and Claims Integration

Many insurers listed on comparison platforms now provide fully digital policy documents, mobile apps, and online claims submission.

When comparing the market, it is important to consider how easy it will be to manage the policy and submit claims digitally while traveling.

Real-World Travel Insurance Providers Commonly Compared

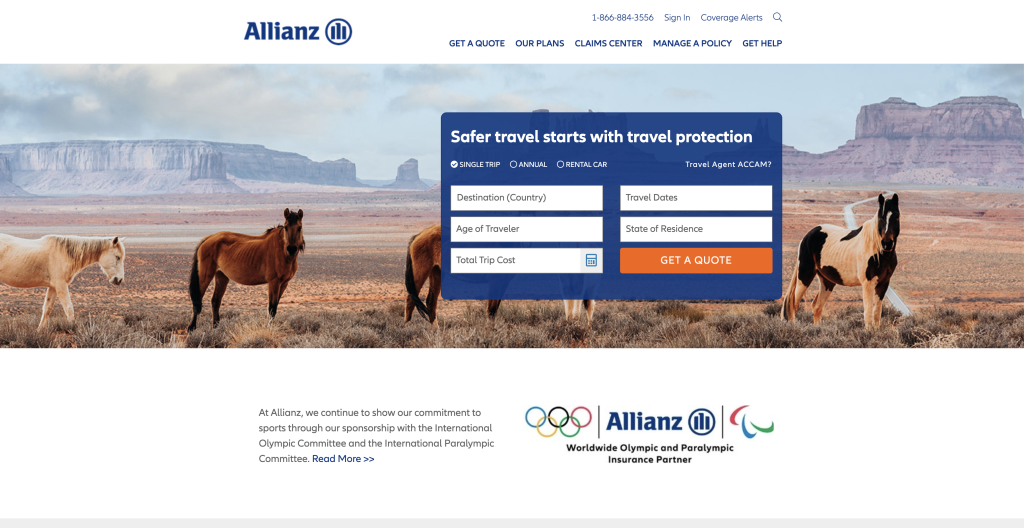

Allianz Travel Insurance

Allianz is frequently featured on travel insurance comparison platforms due to its comprehensive coverage and global presence. Policies include strong medical limits, trip cancellation cover, and 24/7 emergency assistance.

Allianz is known for reliable claims handling and an extensive international medical network.

Use case: Ideal for travelers who want dependable, premium coverage and are comparing top-tier insurers.

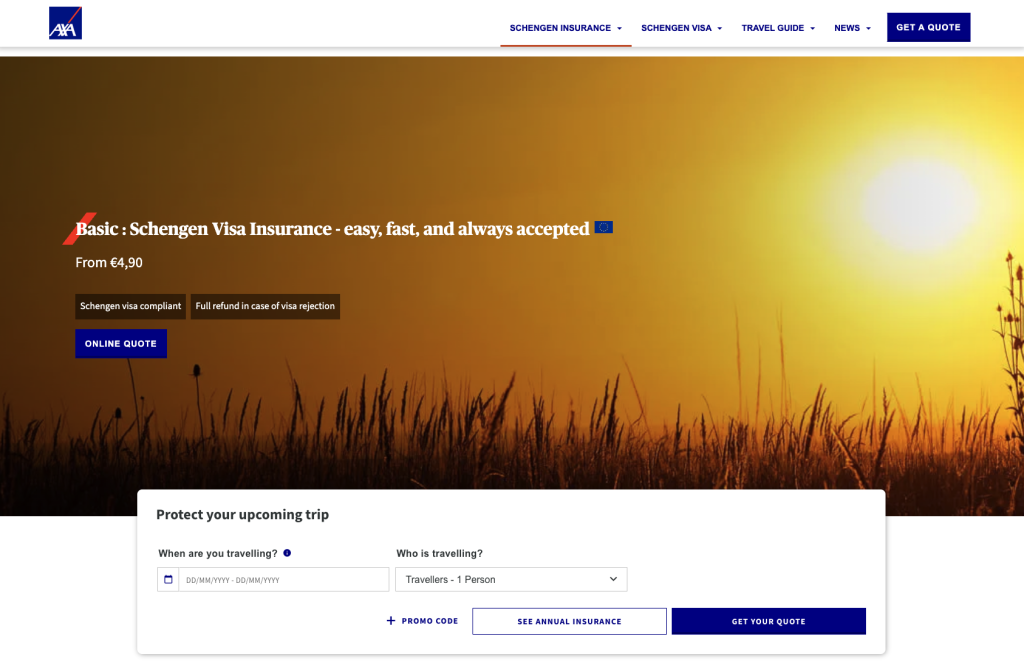

AXA Travel Insurance

AXA is a popular choice on comparison platforms, especially for European travel. Its policies are often visa-compliant and include robust medical and disruption cover.

AXA’s clarity and international medical network make it a strong competitor in market comparisons.

Use case: Suitable for travelers visiting Europe or destinations with high healthcare costs.

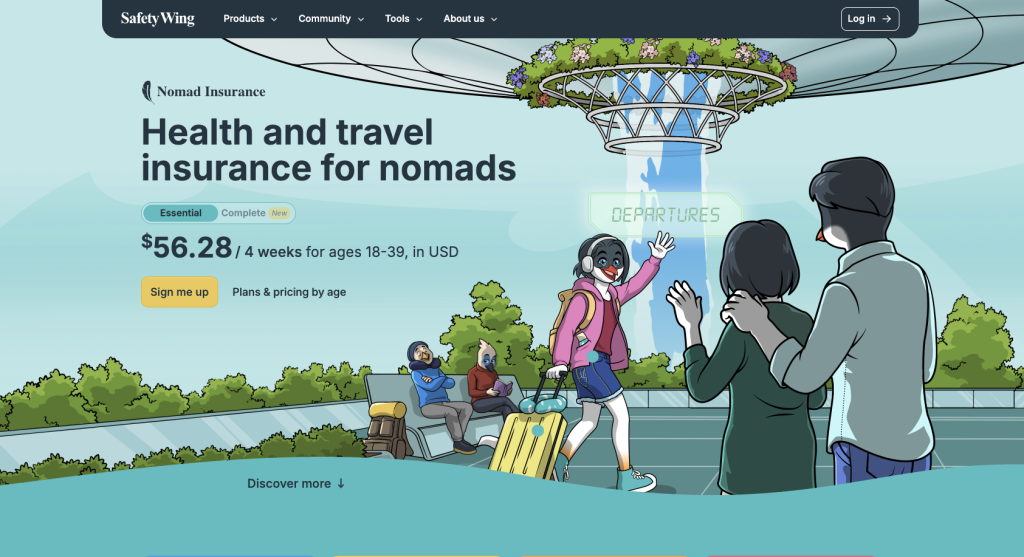

World Nomads Travel Insurance

World Nomads is commonly compared by independent and adventure travelers. Coverage includes emergency medical care, evacuation, and trip interruption.

Its flexible, online-only approach makes it appealing to travelers who value accessibility and global coverage.

Use case: Best for travelers comparing flexible policies for varied travel experiences.

Staysure Travel Insurance

Staysure is often featured in market comparisons for older travelers and those with medical conditions. It offers tailored policies following medical screening.

Staysure focuses on transparency and clarity, making it easy to understand coverage details.

Use case: Ideal for mature travelers comparing specialist travel insurance options.

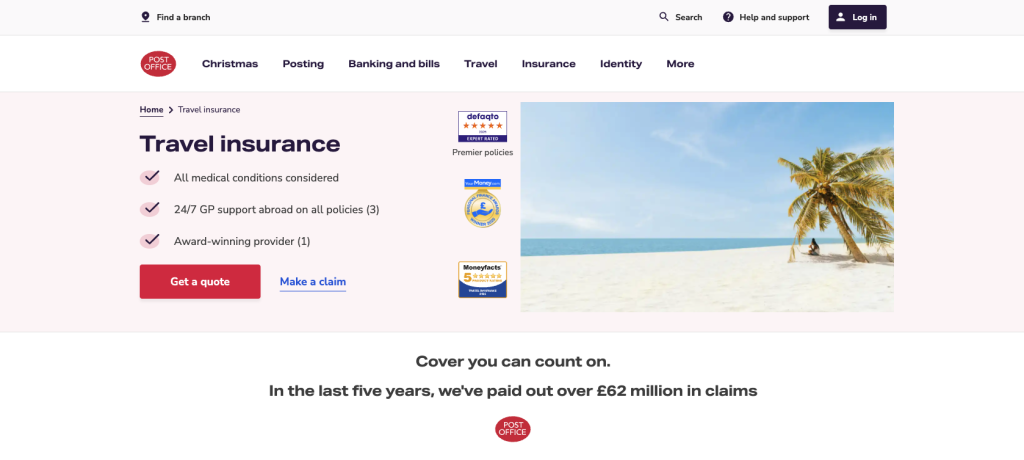

Post Office Travel Insurance

Post Office Travel Insurance is frequently included on comparison platforms due to its strong brand recognition and accessible policies.

Its mix of online and in-branch availability appeals to travelers who value familiarity and support.

Use case: Suitable for travelers comparing trusted, traditional providers alongside digital insurers.

How Comparing the Market Solves Common Travel Insurance Problems

Avoiding Hidden Exclusions and Low Limits

Many travelers discover exclusions only after filing a claim. Comparing the market helps reveal these limitations before purchase.

By reviewing policy wording summaries and coverage highlights, travelers can avoid policies that look good on price but fail in emergencies.

Reducing Financial Risk While Traveling

Medical emergencies, cancellations, and lost belongings can lead to significant expenses without insurance.

Market comparison helps travelers choose policies that protect against the most expensive risks rather than focusing solely on price.

How to Compare the Market Travel Insurance Step by Step

Step One: Define Your Travel Needs

Start by identifying destination, trip duration, number of travelers, and activities planned. This narrows down suitable policy types.

Understanding your needs ensures comparisons are relevant and accurate.

Step Two: Compare Coverage, Not Just Price

Look beyond premiums. Compare medical limits, cancellation benefits, baggage cover, emergency assistance, and exclusions.

This approach ensures you choose insurance that works when it matters most.

How and Where to Buy After Comparing the Market

Buying Through Comparison Platforms

Many travelers complete their purchase directly through comparison platforms after reviewing options. This offers convenience and quick access to multiple insurers.

Always review the full policy wording before confirming purchase.

Buying Directly From Insurers

Some travelers prefer buying directly from the insurer after comparison to access customer support and manage policies easily.

Example purchase buttons:

Who Should Always Compare the Market for Travel Insurance

Families and Holiday Travelers

Families often have higher cancellation and medical risks. Comparing the market ensures adequate protection for all travelers.

This approach balances affordability and comprehensive cover.

Frequent and International Travelers

Frequent travelers benefit from comparing annual and multi-trip policies to avoid overpaying.

Comparison helps identify insurers with reliable claims handling and consistent coverage.

Frequently Asked Questions

Is compare the market travel insurance cheaper?

Comparing the market often reveals better value, but the cheapest policy is not always the best. Coverage quality matters more than price alone.

Do all comparison platforms show the same insurers?

No. Different platforms partner with different insurers. Comparing more than one source can provide broader insight.

When should I compare and buy travel insurance?

Travel insurance should be compared and purchased as soon as travel plans are confirmed to maximize protection.