ASDA Travel Insurance: Coverage, Benefits, and Buying Guide

ASDA Travel Insurance: A Complete Guide to Coverage, Benefits, and Smart Travel Protection

Travel insurance has become an essential part of modern travel planning. From unexpected medical emergencies to flight cancellations and lost baggage, the risks of travelling without insurance can be financially and emotionally overwhelming. For UK travellers looking for affordable and accessible cover, ASDA Travel Insurance is often a popular option.

Known primarily as a major supermarket brand, ASDA also offers financial products, including travel insurance, designed to be simple, competitive, and easy to buy. This guide explains everything you need to know about asda travel insurance, including how it works, its benefits, the technology behind the service, real-world product comparisons, use cases, and how to buy the right policy with confidence.

Understanding ASDA Travel Insurance

What ASDA Travel Insurance Is

ASDA Travel Insurance is a travel insurance product offered under the ASDA brand, typically underwritten by established insurance partners. It provides protection against common travel risks such as medical emergencies, trip cancellations, travel delays, and lost or stolen belongings.

The product is designed to be straightforward and competitively priced, making it appealing to travellers who want essential protection without overly complex policy structures.

Who ASDA Travel Insurance Is Designed For

ASDA Travel Insurance is aimed at a broad audience, including families, couples, solo travellers, and budget-conscious holidaymakers. It is particularly popular with UK travellers who already trust the ASDA brand for everyday needs.

The policies are structured to be easy to understand, making them suitable for travellers who want clarity and affordability rather than highly customised insurance solutions.

Core Benefits of ASDA Travel Insurance

Medical Coverage and Emergency Care Abroad

Medical treatment overseas can be extremely expensive, especially in countries with private healthcare systems. ASDA Travel Insurance typically includes cover for emergency medical treatment, hospitalisation, and medically necessary transport.

This coverage allows travellers to seek medical care without worrying about large out-of-pocket expenses, providing reassurance throughout the trip.

Protection Against Trip Cancellation and Disruption

Travel plans can change unexpectedly due to illness, family emergencies, or travel disruptions. ASDA Travel Insurance can reimburse non-refundable costs such as flights and accommodation if a trip needs to be cancelled or cut short for covered reasons.

This benefit is particularly valuable for holidays involving prepaid bookings.

Technology Behind ASDA Travel Insurance

Digital Policy Access and Online Management

ASDA Travel Insurance is supported by digital systems that allow customers to purchase policies online, access documents electronically, and find emergency contact details quickly.

This digital approach reduces paperwork and ensures travellers can access essential information while abroad.

Claims Handling and Assistance Services

Claims are typically handled through structured online or phone-based systems, supported by global assistance providers. These services help coordinate medical care, manage claims, and provide guidance during emergencies.

The integration of technology improves response times and enhances the overall customer experience.

Types of ASDA Travel Insurance Policies

Single-Trip Travel Insurance

Single-trip ASDA Travel Insurance covers one specific journey, from departure to return. It is suitable for travellers taking one or two holidays per year.

This option allows travellers to tailor cover to the destination and duration of a particular trip.

Annual Multi-Trip Travel Insurance

Annual ASDA Travel Insurance covers multiple trips within a 12-month period, with each trip subject to a maximum duration. This option offers better value and convenience for frequent travellers.

Annual cover eliminates the need to buy separate policies for each trip.

Real-World Travel Insurance Products to Compare

ASDA Travel Insurance

ASDA Travel Insurance offers single-trip and annual policies with cover for medical emergencies, trip cancellation, baggage, and travel disruption. Coverage levels vary depending on the policy selected.

The main appeal lies in affordability, simplicity, and the trust associated with the ASDA brand.

Use case: Ideal for budget-conscious travellers seeking straightforward travel insurance from a familiar UK brand.

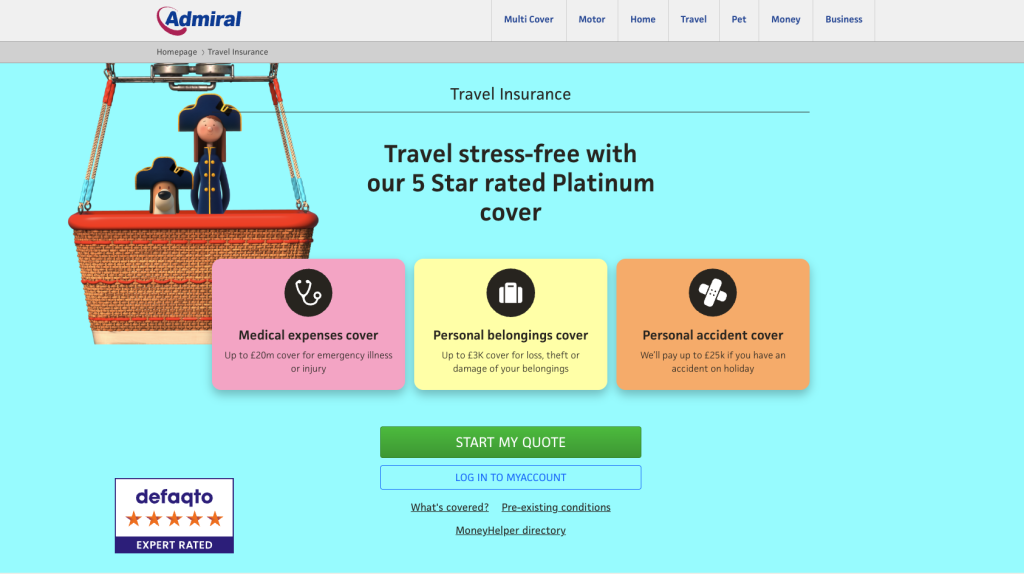

Admiral Travel Insurance

Admiral Travel Insurance is often compared with ASDA due to its strong UK presence and clear policy structure. It offers both single-trip and annual cover.

Admiral appeals to travellers who want a recognised insurer with a simple buying process.

Use case: Suitable for travellers comparing trusted UK insurance brands.

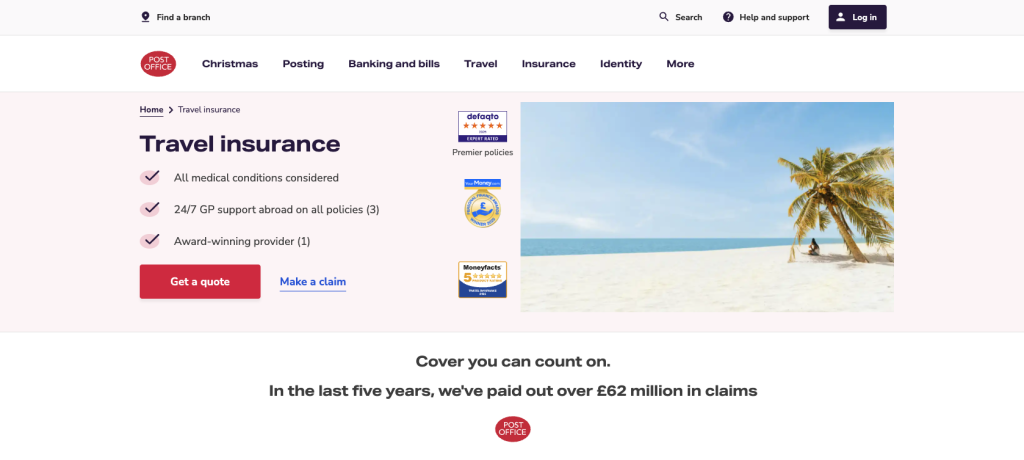

Post Office Travel Insurance

Post Office Travel Insurance is another popular comparison option. It offers both online and in-branch purchasing, with a range of cover levels.

Its accessibility and brand familiarity make it attractive to traditional buyers.

Use case: Ideal for travellers who value in-person support and established brands.

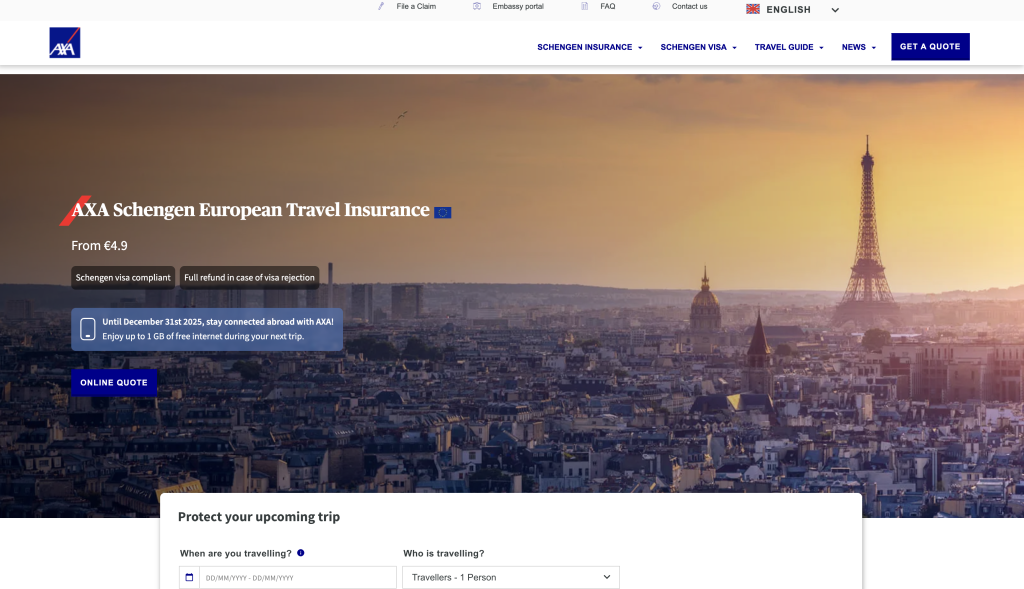

AXA Travel Insurance

AXA offers internationally recognised travel insurance with strong medical cover and visa-compliant policies. It is often compared with ASDA for travellers heading to Europe.

AXA’s global medical network provides added reassurance for international travel.

Use case: Best for travellers visiting Europe or destinations with high healthcare costs.

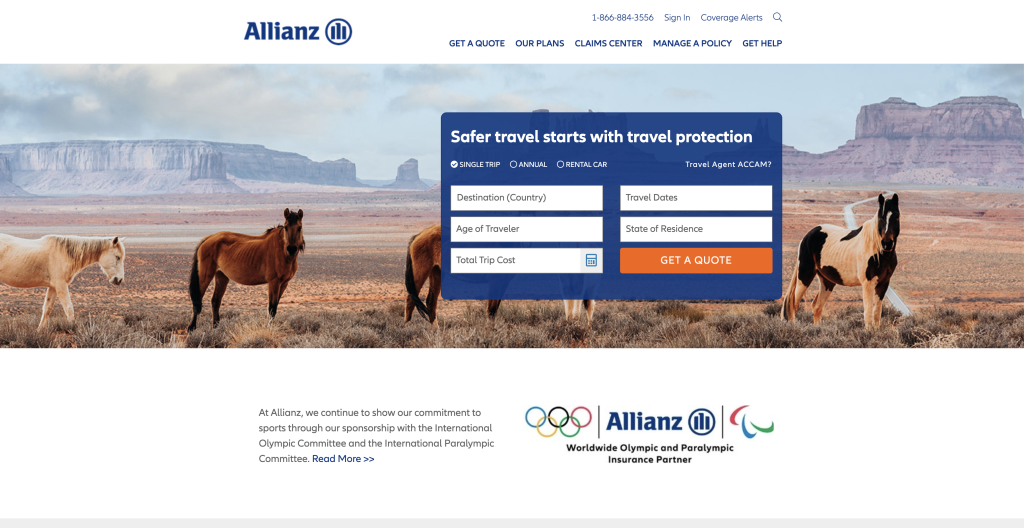

Allianz Travel Insurance

Allianz is a global insurer offering comprehensive travel insurance with strong medical limits and emergency assistance.

It is often compared with ASDA by travellers looking for premium international coverage.

Use case: Suitable for travellers prioritising global medical support over budget pricing.

Why Travellers Choose ASDA Travel Insurance

Affordability and Value for Money

ASDA Travel Insurance is often chosen for its competitive pricing. For many travellers, especially families and holidaymakers, affordability is a key factor.

The policies aim to balance cost and essential coverage, making them accessible to a wide audience.

Brand Familiarity and Trust

ASDA is a well-known household name in the UK. Many customers feel comfortable buying insurance from a brand they already trust for everyday purchases.

This familiarity can make the insurance buying process feel less intimidating.

How ASDA Travel Insurance Solves Common Travel Problems

Reducing Financial Risk While Travelling

Unexpected medical emergencies, cancellations, or lost baggage can result in significant costs. ASDA Travel Insurance helps reduce these risks by covering eligible expenses.

This protection allows travellers to handle disruptions without major financial stress.

Providing Peace of Mind During Holidays

Knowing that insurance is in place allows travellers to focus on enjoying their trip rather than worrying about potential problems.

For families and first-time travellers, this peace of mind is especially important.

How to Buy ASDA Travel Insurance

Steps to Choose the Right Policy

Start by reviewing your travel plans, including destination, duration, and number of trips per year. Decide whether single-trip or annual cover best suits your needs.

Compare coverage limits carefully, focusing on medical cover, cancellation benefits, and exclusions.

Where to Buy and How to Purchase Safely

ASDA Travel Insurance should be purchased directly from the official ASDA Money website to ensure policy authenticity and access to customer support.

Who Should Consider ASDA Travel Insurance

Budget-Conscious Holidaymakers

Travellers looking for affordable, no-frills travel insurance often find ASDA Travel Insurance appealing.

It is suitable for standard leisure travel where essential protection is the priority.

Families and Occasional Travellers

Families and occasional travellers benefit from ASDA’s simple policy structure and competitive pricing.

This makes it easier to insure multiple travellers without excessive cost.

Frequently Asked Questions

Is ASDA travel insurance reliable?

ASDA Travel Insurance is underwritten by established insurers and supported by professional assistance services, making it a reliable option for many travellers.

Does ASDA offer annual travel insurance?

Yes. ASDA offers both single-trip and annual multi-trip travel insurance options.

Is ASDA travel insurance suitable for international travel?

Yes. Policies typically cover international destinations, but coverage limits and exclusions should always be checked before purchase.